The Nation's Moral Bankruptcy Crisis

The country may be emerging slowly from fiscal crisis, but Elayne Clift writes that there is no end to moral bankruptcy in the United States.

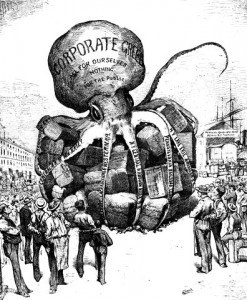

We’re in big trouble in this country. Not only did we nearly go bankrupt financially, we still face serious moral crises in both our private and public sectors. Like Siamese twins, the two are joined at the hip of course, but surgical separation is clearly called for. Government needs to hold the corporate world accountable for its fiscal fiascos and its moral deficiencies and the business world should put people at least on a par with profits, or we are all circling the drain.

One travesty was revealed in a study reported in the journal Environmental Science and Technology in March. Research findings indicated that 80 percent of baby products containing polyurethane foam that were tested, such as car seats, strollers and bassinet mattresses, contained toxic or inadequately tested flame retardants. Many of the chemicals identified in these products, some of which are known carcinogens, have also been found in children’s bodies and in our food. Fortunately, Senator Frank Lautenberg (D-NJ) has introduced the Safe Chemicals Act of 2011. No doubt chemical industry lobbyists are already swarming on Capitol Hill. Some of them may have been legislators themselves once, given revolving door Washington careers.

Anyone who watched the Congressional hearings in which executives of the big five multinational oil companies threatened members of Congress when questioned about corporate profits and the need for oil subsidies saw how arrogant the big boys of business are. Remove our subsidies? We’ll take our business off-shore! Armed with egos the size of Mt. McKinley, this fraternal order of elitists, whose companies collectively made nearly a trillion dollars in profit over ten years, simply gave Congress the finger. Yet they glibly expect to receive $36.5 billion in various tax subsidies over the next decade. Just two of these tax breaks would save $18 billion over that same ten years.

Wall Street, which made a quick recovery from its banking maneuvers, stands to see impressive profitability this year. Bonuses for 2010 are down a bit but JPMorgan Chase set aside an average of more than $369,000 per employee. At Goldman Sachs the average bonus is $430,700, despite a 14 percent drop from 2009. It’s better if you’re in top management. Citigroup’s chief financial officer got $2.33 million in salary while the company’s vice chair received $4.29 million. And still no one has been held accountable for the gross wrongdoing that continues to have people reeling—and losing their homes.

Pharmaceutical company executives are right up there with bankers and health insurance industry execs when it comes to screwing us little folk. One of their games is “pay-for-delay” deals. This machination involves paying generic companies to drop patent challenges so the big boys can keep their monopolies longer while Medicare and Medicaid recipients lose out on cost reductions. Here’s one example reported by the Los Angeles Times: “According to a lawsuit filed by the Federal Trade Commission, the company Cephalon paid a total of $200 million to several generics companies to get them to drop patent challenges to its drug Provigil. The deals staved off competition from no-name rivals until 2012.” Apparently the company’s CEO thought this was great. “We were able to get six more years of patent protection,” he said. “That's $4 billion in sales.”

Health insurers also seem to have been absent when ethics class was offered. While most Americans suffered through a deep economic recession, health insurance companies increased their profits by 56 percent in 2009, the same year that nearly three million people lost their private coverage. The country’s five largest for-profit insurers closed 2009 with a combined profit of over $12 billion according to Health Care for America Now. How did they do it? Largely by dropping subscribers and raising premiums. Cigna, one of the largest health insurance companies in the United States, increased its profits 346 percent while enrollment dropped by 5.5 percent. Similarly, California’s largest insurer, Blue Cross, raised its premiums by over 30 percent.

It’s no good expecting the courts to hold corporate feet to the fire. Last year the Supreme Court favored corporations when it ruled that they could run political ads during election campaigns. As then Representative Alan Grayson (D-FL) noted, the decision basically “legalizes bribery on the largest scale imaginable. Corporations will now be able to reward the politicians that play ball with them—and beat to death the politicians that don’t.”

When the court's decision was handed down, Johann Hari, a columnist for England’s Independent, noted in the Huffington Post that “the U.S. political system now operates within a corporate cage” and that “lobbyists now often write the country’s laws.” Then he asked some key questions: “How do you re-regulate the banks if the Senate is owned by Wall Street? How do you launch a rapid transition away from oil and coal to wind and solar, if the fossil fuel industry owns Congress? How do you break with a grab-the-oil foreign policy if Big Oil provides the invitation that gets you into the party of American politics?”

These are critical questions. When asked by observers outside the United States, they augment American observers’ concerns. What’s disturbing is that they are yet to be answered.

More articles by Category: Economy, Health, Politics

More articles by Tag: